What you should know about Nigerian Student Loan, easy or hard

The Nigerian student loan is designed to help Nigerian students cover the cost of their education. The loan allows eligible students to borrow money from the government or private lenders to pay for their tuition, accommodation, books, and other expenses. In this article, we will discuss what you should know about the Nigerian student loan, including who introduced it, how to access it, requirements to get it, and whether it is easy or hard to obtain.

The Nigerian student loan is designed to help Nigerian students cover the cost of their education. The loan allows eligible students to borrow money from the government or private lenders to pay for their tuition, accommodation, books, and other expenses. In this article, we will discuss what you should know about the Nigerian student loan, including who introduced it, how to access it, requirements to get it, and whether it is easy or hard to obtain.

Come back to read more ...

How to access the Nigeria Student Loan

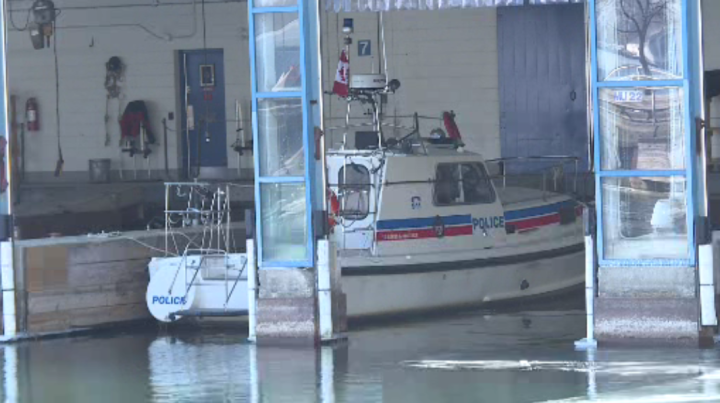

President Bola Tinubu on Monday signed the Student Loan Bill into law.

The Student Loan Bill was proposed by the former speaker of the 9th House of Representatives, Femi Gbajabiamila, and it was passed by the lawmakers in late May 2023.

In November 2022, Gbajabiamila urged the Education Bank to provide interest-free loans to students in tertiary institutions in order to make funding education at that level more accessible to all.

“The bill proposes to provide students with interest-free loans.”

Following the passage by the House and assent by President Tinubu, here are seven things to know about the Student Loan Act:

(1) The new act will establish the Nigerian Education Bank, which will supervise, coordinate, administer and monitor the management of student loans in Nigeria.

(2) Applicants will go through screening to determine whether they meet the requirements for the loan.

(3) Students in all the higher institutions are eligible for the loan.

(4) It provides funds for all education-related matters, including textbooks, and research.

(5) It is only accessible to students studying in Nigeria.

(6) There will be jail terms for student loan defaulters.

(7) The repayment of the loan will begin two years after the National Youth Service Corps Scheme is completed.

Is this student loan evil or helpful?

Let continue...

What you should know about Nigerian Student Loan

We are all happy that President Bola Ahmed Tinubu introduce student loan to indigine of Nigeria within few weeks on his seat, though it was part of his manifesto to introduce it.

Is the student loan for every student or not? According to David Hundeyin on his Twitter account, he made it clear to us what Nigeria student loan stand for and who it is for.

"I actually just read through this student loan act, and I've realised that I've been wasting my breath arguing.

Chapo Batman has no genuine intention of giving out any silly student loans. Na pure bobo. Baba just dey whine????

Let me break down these loan conditions" on David Hundeyin Twitter Page.

I actually just read through this student loan act, and I've realised that I've been wasting my breath arguing.

Chapo Batman has no genuine intention of giving out any silly student loans. Na pure bobo. Baba just dey whine????

Let me break down these loan conditions⬇️ pic.twitter.com/5L6UIdxnoS — David Hundeyin (@DavidHundeyin) June 15, 2023

To get this "student loan," you need to bring a Director-level civil servant or a lawyer with 19 years post-call history, or a judge.

Why would anyone who has access to these people need a student loan? pic.twitter.com/llJB74DOGT — David Hundeyin (@DavidHundeyin) June 15, 2023

The Civil Service Director or the judge or the 10 year post-call lawyer serving as guarantor must then write a letter promising to pay the loan if the student doesn't pay it.

They must attach their employment letter or CAC registration document to the letter???? pic.twitter.com/gjHXZOExlA — David Hundeyin (@DavidHundeyin) June 15, 2023

Full Act here:https://t.co/dpvI3m6qxz — David Hundeyin (@DavidHundeyin) June 15, 2023

I don't want you to read this with hatred, I want you to sit and read all this and give your comment on what you think about the student loan.

Reaction on Nigeria student loan in Nigeria

Twitter user has react after reading the secret behind the Nigeria Student Loan introduce by President Bola Ahmed Tinubu,

I stopping reading and knew it was BS when I saw family income must be less than N500k per annum. That means, Papa and Mama must be earning maximum of N40k a month for you to qualify. That means if your parents earn minimum wage of N30k( times 2 equals N60k) you don’t qualify. — Dr. A. TuruMbe (@NDrAgwoTurumbe) June 15, 2023

My point exactly. Did you also see the part where he said “no loan for you if you’re trafficking drugs”?

Drug baron want commot his competitors ???? — IRUNNIA (@Irunnia_) June 15, 2023

The truth is that government institutions will die off and only the private will ones will strive. — Nkanu_Ogbozürú (@amadimchinedu) June 15, 2023

Wait o.

Cos what's coming next is University autonomy.

Meaning Fee increase.

So you need a Guarantor that is ready to Chest upwards of 1 million Naira for a Student whose Family makes less than 500k/yr. And that Student is graduating into an economy with 41% unemployment rate. — The other Son Of God. (@9jaDisciple) June 15, 2023

Eligibility of Nigeria Student Loan

To apply for a loan under the Students Loan Bill, prospective students must satisfy the conditions outlined in Section 17 of the Act.

These conditions to Nigeria student loan are as follows:

- Admission into Accredited Institutions: Applicants must have secured admission into Nigerian universities, polytechnics, colleges of education, or vocational schools established by the Federal Government or any state government.

- Income Limit: The applicant’s individual or family income must not exceed N500,000 per annum.

- Guarantors: Each applicant must provide a minimum of two guarantors. The guarantors must fall into one of the following categories: (i) Civil servants of at least level 12 in the service, (ii) Lawyers with a minimum of 10 years of post-call experience, (iii) Judicial officers, or (iv) Justices of the peace.

Ineligibility for Nigeria Student Loan Access

Under the Students Loan Bill, certain circumstances disqualify students from accessing the loan. These disqualifying factors include:

- Previous Loan Default: If a student is proven to have defaulted on any previous loan granted by any organization, they are disqualified from accessing the loan.

- Exam Malpractice: If a student is found guilty of exam malpractice by any school authority, they will be disqualified from receiving the loan.

- Conviction of Felony or Offenses of Dishonesty or Fraud: Students who have been convicted of a felony or any offense involving dishonesty or fraud are ineligible for the loan.

- Drug Offenses: Students who have been convicted of drug offenses are disqualified from accessing the loan.

- Parental Loan Default: If any of the student’s parents have defaulted on a student loan or any other loan granted to them, the student will be disqualified from receiving the loan.

These disqualification criteria ensure that the loan is allocated to students who meet the necessary ethical standards and have a genuine commitment to their academic pursuits.

Application Process and Documentation

The Students Loan Bill outlines the method of application for prospective students seeking the loan. The application process involves the following steps:

Submission through the Applicant’s Bank: All applications must be submitted through the applicant’s bank to the Chairman of the Committee established under the Act.

A cover letter signed by the vice-chancellor, rector, or the head of the institution, along with the student affairs officer of the institution, should accompany the application.

Required Documents: Each application must be accompanied by several documents, including a copy of the student’s admission letter.

Additionally, a letter from the guarantors addressed to the Chairman of the Committee, recommending the student for the loan and accepting liability in the event of default, is required.

The application should also include two passport photographs from each guarantor, information on the guarantors’ employment and proof of employment with the named organization, as well as particulars of the guarantors’ business registration or relevant authority if self-employed.

Application Status Communication: The Committee is obligated to communicate the status of the applicant’s application within 14 days of receiving the application.

Disbursement of Nigeria Student Loan

The Students Loan Bill sets out the process for loan disbursement:

Timely Processing: Processing of any applicant’s application and disbursement shall be completed within 30 days of the application reaching the Chairman of the Committee, subject to Section 18 (4) of the Act.

This ensures that loans are processed efficiently and promptly.

Repayment of Nigeria Student Loan

The repayment terms for beneficiaries of the loan are outlined in the Students Loan Bill:

Commencement of Repayment: Loan repayment shall commence two years after completion of the National Youth Service Corps program.

Salary Deduction: Repayment shall be facilitated through a direct deduction of 10% of the beneficiary’s salary at source by the employer. The deducted amount will be credited to the Fund.

Notification of Job Changes: In the event of a job change, beneficiaries are required to notify the Chairman of the Committee within 30 days of resuming employment with the new employer, providing details of the new job.

Self-Employed Individuals: Self-employed beneficiaries are required to remit 10% of their total monthly profit to the Fund.

Reporting of Self-Employment Status: Self-employed individuals assuming this status must submit relevant information, such as business name, address, location, registration documents (if applicable), bank details, partner names, and director/shareholder names, to the Committee within 60 days.

Penalties for Default: Any individual who defaults on the provisions of subsection (5) or aids in such default commits an offense and, upon conviction, is liable to a fine of N500,000 or imprisonment for a term of two years, or both.

This emphasizes the importance of adhering to the repayment obligations outlined in the Act and discourages default or aiding default.

The loan repayment terms and penalties aim to ensure timely and responsible repayment, contributing to the sustainability of the loan program and the availability of funds for future students.

What's Your Reaction?